Everything about Home Renovation Loan

Everything about Home Renovation Loan

Blog Article

The Ultimate Guide To Home Renovation Loan

Table of ContentsThe Definitive Guide to Home Renovation LoanAn Unbiased View of Home Renovation LoanThe Definitive Guide to Home Renovation LoanAll about Home Renovation Loan6 Easy Facts About Home Renovation Loan Explained7 Simple Techniques For Home Renovation Loan

Potentially. In Canada, there go to least a pair of various methods to include renovation prices to home mortgages. Occasionally lenders re-finance a home to gain access to equity needed to complete minor remodellings. If your existing home loan balance is listed below 80% of the current market value of your home, and your family members income supports a bigger home loan amount, you might qualify to refinance your home mortgage with added funds.This allows you to finish the job needed on the home with your own funds. Once the improvements are full, the lender launches funds to you and your home mortgage amount increases. You may purchase a home with a mortgage of $600,000, and a renovation amount of $25,000 (home renovation loan).

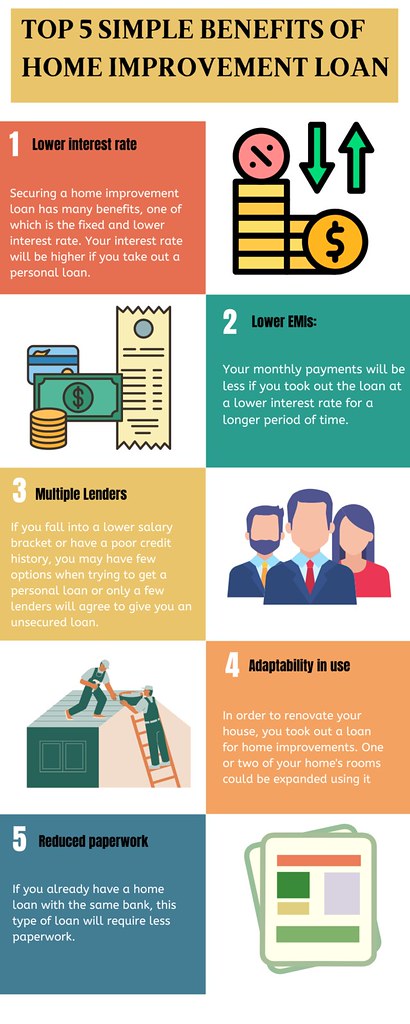

A home improvement loan can give quick financing and flexible repayment choices to home owners. Home enhancement car loans may include greater prices and charges for borrowers with poor debt. These loans can assist build your credit and enhance the worth of your home, but they also have prospective downsides such as high fees and protected choices that place your possessions in jeopardy.

Home Renovation Loan - Questions

You may fund whatever from little improvements to cellar conversions. Personal finances are one usual kind of home renovation funding, yet various other kinds like home equity finances and cash-out refinancing use their very own advantages. Like all loans, home improvement loans have drawbacks. If you don't have excellent credit history, it's most likely that you'll be offered high interest prices and costs if accepted.

Home renovation financings aren't for everybody. Elements like charges, high rates and tough credit history pulls can interfere with the financing's value to you and cause monetary stress and anxiety later on. Not every loan provider bills the same charges. Your financing may have an origination cost deducted from the total amount you receive or contributed to the amount you obtain.

Home Renovation Loan Fundamentals Explained

Both can be avoided. The higher your interest rate, the more you will certainly have to invest each month to fund your home tasks.

If you're unable to pay your finance and enter default, the loan provider can confiscate your collateral to satisfy your financial obligation. Also if a safeguarded car loan comes with lower rates, the risk capacity is much greater and that's a crucial variable to consider.

And if you miss any payments or default on your lending, your lender is likely to report this to the credit report bureaus. Missed payments can remain on your credit rating record for up to 7 years and the better your credit rating was before, the further it will certainly fall.

Unsecured home renovation finances typically have rapid funding rates, which might make them a far better funding choice than some browse this site options. If you require to borrow a lump sum of money to cover a project, a personal loan might be a great idea.

The Buzz on Home Renovation Loan

There are multiple types of home enhancement financings beyond just personal lendings. Concerning 12.2. Unsafe personal loan rate of interest are usually higher than those of protected loan types, like home equity fundings and HELOCs. They offer some perks in exchange. Funding times are quicker, given that the loan provider does not have to analyze your home's worth which also indicates no closing costs.

You put up your home as security, driving the interest rate down. This also may make a home equity finance much easier to qualify for if you have poor debt.

Existing ordinary rates of interest: Regarding 9%. A HELOC is a secured finance and a revolving credit line, meaning you attract money as check out here required. Rates of interest are usually reduced but typically variable, so they fluctuate with the market. Just like home equity car loans, the greatest disadvantages are that you might shed your home if you can not pay what you owe which closing expenses can be costly.

, you would certainly take out a brand-new home loan for even more than you owe on your residence and utilize the distinction to money your home enhancement project. Shutting prices can be high, and it might not make feeling if rate of interest rates are greater than what you're paying on your existing home mortgage financing.

Examine This Report about Home Renovation Loan

This government loan is guaranteed by the Federal Real Estate Administration (FHA) and designed particularly for home improvements, improvements and repair services. The maximum amount is $25,000 for a single-family home, lower than a lot of your various other choices. You may need to offer security depending upon your funding amount. If you're a low-to-middle-income house owner, this might be the best method.

These periods typically last between 12 and 18 months.

That makes this approach best for brief- and medium-term tasks where you have a good quote of your costs. Meticulously take into consideration the possible impact that taking on more financial website here obligation will certainly have on your economic wellness. Also prior to contrasting lending institutions and checking into the information, perform a financial audit to ensure you can handle even more debt.

And don't forget that if you cash out financial investments that have increased in worth, the cash will be tired as a funding gain for the year of the withdrawal. Which suggests you may owe cash when you submit your taxes. If you're concerning to buy a fixer upper, you can include the amount you'll require to fund the remodellings right into your mortgage.

Home Renovation Loan Can Be Fun For Anyone

Report this page